NTPC Green Energy’s IPO: A Comprehensive Overview and Market Analysis

NTPC Green Energy Limited (NGEL), the green energy arm of NTPC, recently concluded its initial public offering (IPO) with a mixed response from the market. The IPO, which closed for subscription on November 22, 2024, was oversubscribed 2.42 times, reflecting significant interest particularly from retail investors who subscribed to 3.44 times their allocated quota.

IPO Details and Market Response

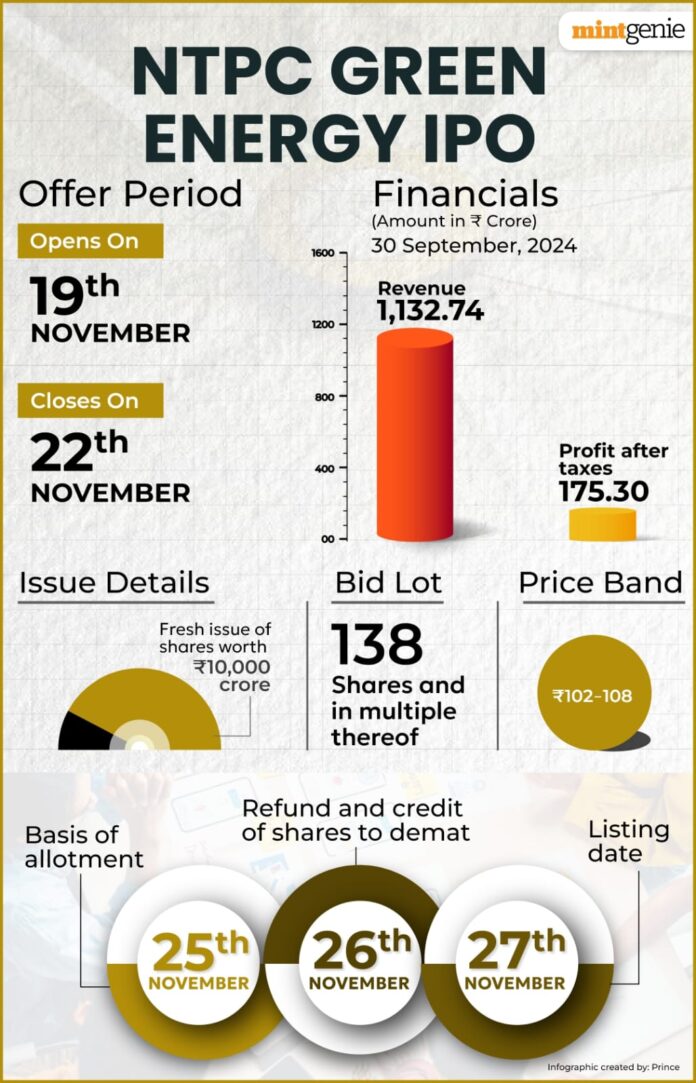

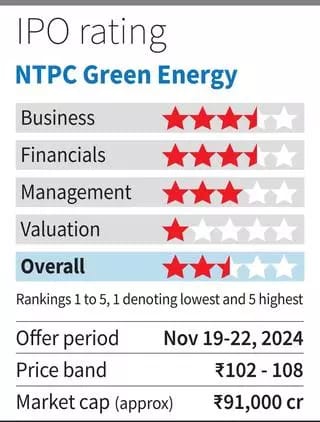

The IPO was priced in the range of ₹102 to ₹108 per share, with a lot size of 138 shares. It raised ₹10,000 crore, marking it as one of the significant public issues by a Public Sector Undertaking (PSU) in recent times. The allotment of shares was finalized on November 25, 2024, with the listing scheduled for November 27, 2024, on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE)【34†source】【33†source】.

Despite the overall positive sentiment, the listing was anticipated to be relatively muted, with market experts predicting the stock to open close to its issue price. This cautious outlook was attributed to the prevailing market conditions and the general performance trends of recent PSU IPOs. The grey market premium (GMP) for NTPC Green Energy’s shares was observed to be around ₹3.50, indicating a slight premium over the issue price【34†source】.

Long-term Prospects and Strategic Importance

NTPC Green Energy’s IPO is not just a financial event but a strategic move in India’s transition towards renewable energy. The company aims to achieve a renewable energy capacity of 60 GW by 2032, aligning with national goals of sustainability and reducing carbon emissions. NGEL has been actively involved in various projects, including Ultra Mega Renewable Energy Power Parks (UMREPP), which position it as a crucial player in India’s green energy landscape【34†source】.

Experts and analysts have largely recommended holding the stock for the long term, citing the company’s strong fundamentals and strategic importance in India’s energy sector. Anil Singhvi, Managing Editor of Zee Business, advised investors to subscribe to the issue with a three-year perspective, highlighting that significant gains might not be immediate but are expected as the company scales its renewable energy projects【33†source】.

Investment Strategies and Market Sentiment

For short-term investors, market experts have recommended a cautious approach with appropriate stop-loss strategies to mitigate potential volatility. The initial muted listing reflects a broader market sentiment towards PSU IPOs, which often show subdued performance in the immediate term but hold strong potential for long-term gains given their strategic roles and government backing.

The overall subscription data reveals strong participation from various investor categories, with retail investors leading the demand, followed by Qualified Institutional Buyers (QIBs) and Non-Institutional Investors (NIIs). This diverse investor interest underscores confidence in NTPC Green Energy’s business model and growth prospects【34†source】.

Conclusion

NTPC Green Energy’s IPO marks a significant milestone in India’s renewable energy journey. While the immediate market reaction has been cautious, the long-term prospects for the company remain robust, driven by strategic initiatives and strong market fundamentals. Investors are advised to consider a long-term investment horizon to fully capitalize on the growth potential of NTPC Green Energy as it spearheads the transition towards a sustainable energy future in India.

Thanks for visiting our website . We will provide you accurate information about Events and News.