Title: “Latest Tobacco GST News: Impacts, Insights, and the Road Ahead”

Tobacco is one of the most heavily taxed industries in India, with the government relying on the sector for a significant portion of its revenue. Over the years, the Goods and Services Tax (GST) has played a crucial role in reshaping the taxation structure for various products, including tobacco. As we enter the year 2024, there have been several new developments and discussions regarding the GST on tobacco, its impact on businesses, consumers, and the government. This blog explores the latest updates on tobacco GST, including key news, legislative changes, market impact, and future outlook.

The GST Structure and Tobacco: A Quick Recap

Before we delve into the latest updates, it’s important to understand how tobacco has been taxed under the GST regime. Since the implementation of GST in India in July 2017, tobacco and tobacco products have been classified under the Goods and Services Tax Act and subjected to a dual tax structure — the Goods and Services Tax (GST) and the National Calamity Contingent Duty (NCCD).

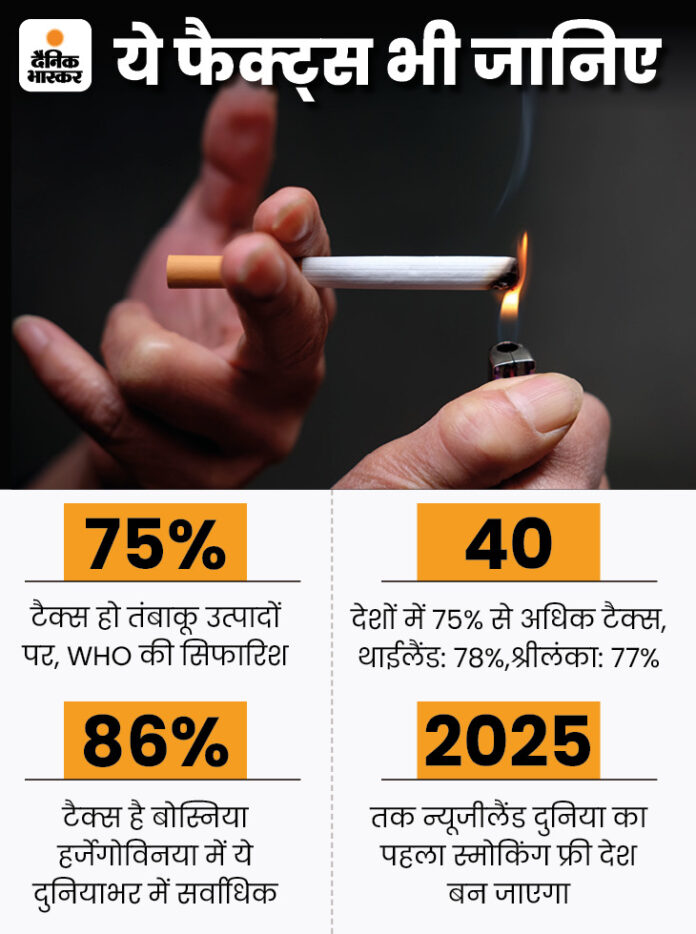

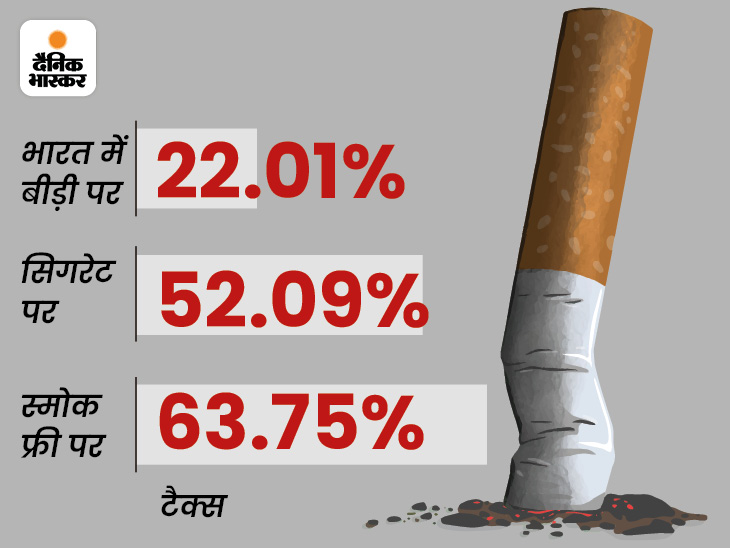

The GST rates for tobacco products have been set at 28% for most items, including cigarettes, smokeless tobacco, and beedis. However, the government has added a sin tax (or cess) on certain tobacco products to curb consumption and to ensure that the revenue collected from this sector is directed toward public health initiatives and welfare schemes.

The introduction of GST has replaced multiple indirect taxes and led to a more uniform tax structure across the country. However, it has not been without controversy. As the government seeks to balance revenue collection with the health implications of tobacco consumption, discussions around GST on tobacco remain an ongoing and evolving topic.

Recent Updates on Tobacco GST: What’s New?

As of late 2023 and early 2024, there have been significant discussions and updates regarding tobacco taxation under the GST framework. Below, we explore some of the most noteworthy developments.

1. Proposal for GST Rate Hike on Cigarettes and Other Tobacco Products

One of the most significant pieces of news in the tobacco GST landscape has been the proposal to increase the GST rates on cigarettes, beedis, and smokeless tobacco. The Central Board of Indirect Taxes and Customs (CBIC) has been exploring the possibility of raising taxes on tobacco products to further discourage consumption and to address the growing public health concerns associated with tobacco use.

In 2023, the Indian government raised the cess on cigarettes, which had a direct impact on the final retail price. With the government grappling with rising health costs related to tobacco consumption, this hike is aimed at discouraging smoking while increasing government revenue.

As a result of these proposals, the price of cigarettes has already seen an uptick. Industry experts suggest that such increases in tax rates could further push smokers towards illicit tobacco products or reduce the affordability of legal tobacco options. There is also concern that a hike in GST could negatively impact the tobacco farming industry, particularly in states that are major producers of raw tobacco.

2. Impact of GST on Tobacco Farming and Manufacturing

Another critical area of focus in the latest tobacco GST news is the impact on tobacco farming and the manufacturing sector. The tobacco industry in India involves millions of farmers, manufacturers, and distributors. With the increase in taxes, the profitability of many businesses involved in the production of tobacco has been under pressure.

Farmers, especially those growing flue-cured Virginia tobacco, have raised concerns about the increased cost burden passed on from higher GST rates and cess. Many of them have pointed out that the already volatile nature of the tobacco market, combined with rising input costs and the threat of anti-tobacco legislation, is making it more difficult to sustain their livelihoods.

Manufacturers of cigarettes and other tobacco products are also feeling the pinch. Smaller manufacturers, in particular, are struggling with the high compliance costs associated with GST. Large manufacturers, while better positioned, are still facing pressure from the rising costs of production due to increased taxes and growing regulatory scrutiny. These concerns have resulted in a collective request from industry bodies to reconsider any further hikes in tobacco taxes, arguing that excessive taxes could drive consumers to the illegal market.

3. Enforcement of GST on Illicit Tobacco Products

Another ongoing issue surrounding tobacco GST has been the increasing prevalence of illicit tobacco products, which are not subject to the same tax and regulatory standards as legally manufactured goods. The Indian government has been ramping up efforts to combat the illicit tobacco trade, which has been growing due to the high taxation on legal tobacco products.

The introduction of GST has made it easier for authorities to track the movement of goods, but illegal trade continues to thrive in some regions. Reports from the Directorate General of GST Intelligence (DGCI) have indicated that there is a growing concern over the sale of unbranded, untaxed cigarettes, which are often sold at lower prices than their legitimate counterparts.

In response, the government has intensified surveillance and enforcement activities, focusing on preventing the production, sale, and distribution of such products. Increased raids and checks on unregistered manufacturers and distributors have been carried out across various states. In fact, several high-profile seizures of illicit tobacco products were reported in 2023, with authorities tightening their grip on the trade to ensure compliance with the GST framework.

Market Impact of Tobacco GST Changes

The recent changes in tobacco GST have had far-reaching consequences on the market. Let’s break down the key impacts on different stakeholders.

1. Impact on Tobacco Consumers

The rise in tobacco taxes directly impacts consumers. Higher GST rates and increased cess on products such as cigarettes have led to higher retail prices, making tobacco products less affordable. This is part of the government’s strategy to reduce tobacco consumption, which is a major health concern in the country.

Higher prices may deter occasional smokers and discourage new users, contributing to a potential reduction in overall consumption. However, long-term and heavy smokers may find it difficult to quit, and they might simply absorb the price increases. On the other hand, some consumers may seek illicit products, which could defeat the purpose of taxation and harm government revenue.

It’s also important to note that tobacco taxes are not just about raising revenue; they are a tool for public health. The government hopes that by making tobacco less accessible through price hikes, it will discourage smoking, particularly among younger people. Public health experts argue that this approach aligns with global anti-smoking trends, where governments worldwide are using tax hikes as a means of reducing tobacco-related diseases.

2. Impact on Tobacco Manufacturers

For manufacturers of legal tobacco products, the rising GST rates have significant implications. While large companies can manage the tax burden, smaller manufacturers are finding it difficult to cope with the increasing cost of doing business. Smaller manufacturers argue that higher taxes make it harder to compete with illicit trade, which operates outside the regulatory framework and evades the GST.

Additionally, some manufacturers have warned that increasing taxes could lead to job losses in the sector. The tobacco industry, especially in rural areas, provides employment to millions of workers, including farmers, factory workers, and distribution personnel. A reduction in production due to higher taxes could result in job cuts and adversely affect local economies.

3. Impact on Government Revenue

While tobacco taxes contribute a significant portion to government revenue, there is an ongoing debate about whether the rising tax burden will lead to reduced overall tax collection. If the rise in GST rates leads to a sharp decline in tobacco consumption, the government could face a shortfall in tax receipts.

On the flip side, the government is betting that the higher taxes will yield substantial revenue, which can be redirected to public health initiatives aimed at curbing smoking-related diseases. Additionally, the revenue generated can be used to fund programs focused on smoking cessation, healthcare infrastructure, and raising awareness about the dangers of tobacco use.

The Road Ahead: What’s Next for Tobacco GST?

As we look toward the future, it is clear that tobacco taxation and GST will continue to evolve. With ongoing public health concerns, there is likely to be more emphasis on reducing tobacco consumption through fiscal policy, which could result in even higher taxes on tobacco products in the years to come.

However, stakeholders in the tobacco industry are pushing for a more balanced approach, one that doesn’t disproportionately burden the legal tobacco sector while still achieving the government’s public health goals. A key issue will be how the government addresses the growing illicit trade of tobacco products, which undermines the intent of the taxation framework.

Additionally, with the rise of alternative products like e-cigarettes and vaping devices, it’s likely that the government will consider adjustments to the GST structure to address these newer tobacco-related products. As these alternatives become more popular, the regulatory and taxation frameworks will need to evolve to ensure that they don’t become a loophole for smokers seeking to avoid high taxes on traditional tobacco.

Conclusion

The latest tobacco GST updates reflect a fine balance between taxation for revenue generation and public health concerns. While the government is determined to reduce tobacco consumption through higher taxes, the impact on consumers, manufacturers, and revenue collection must be closely monitored. As the tobacco industry adapts to these changes, the question remains: will the tax hikes lead to a significant decline in tobacco use, or will they simply push more consumers toward illicit products? Only time will tell, but for now, the tobacco sector continues to face a complex and ever-changing regulatory environment.

Disclaimer: This blog is for informational purposes only and does not constitute financial, legal, or tax advice. Please consult a professional for advice on tobacco taxation and its impact.